Comparing the Top Sheet Metal Fabricators in Bangalore: 2025 Guide

If you’re sourcing sheet metal fabricators in Bangalore in 2025, you’re spoiled for choice—yet that abundance can make vendor selection harder, not easier. Bangalore’s manufacturing belt (Peenya, Bommasandra, Whitefield–Hoskote, Jigani, and Hosur Road corridors) has matured into a dense ecosystem of precision job shops, high-volume contract manufacturers, and niche specialists in laser cutting, bending, welding, surface finishing, and turnkey assembly. This guide helps you compare options with a clear, practical framework so you can shortlist the right partners for prototyping, batch production, or full-scale serial manufacturing.

Why Bangalore for Sheet Metal in 2025?

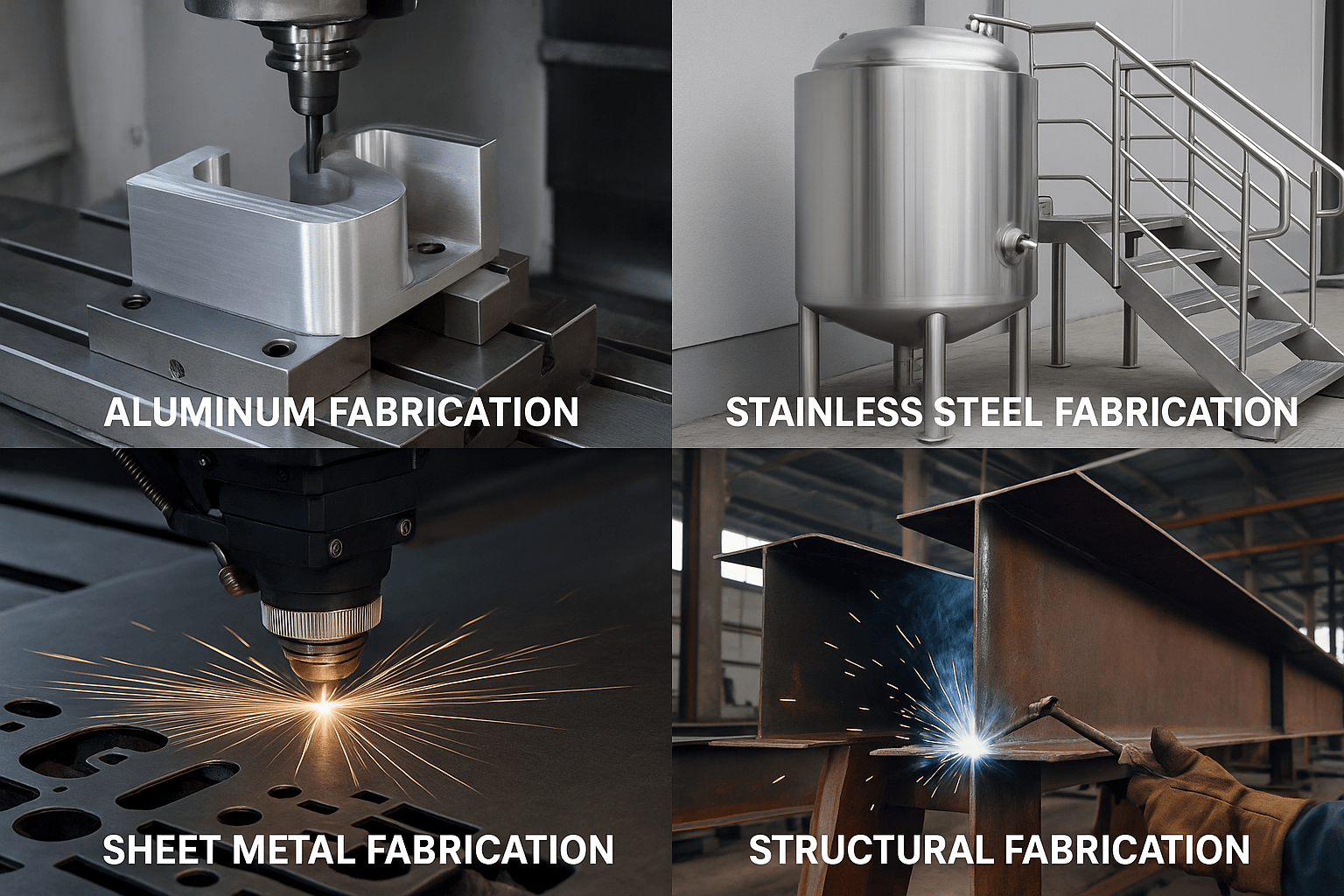

Bangalore’s fabrication scene has evolved beyond simple cut-bend-weld work. You’ll now find:

-

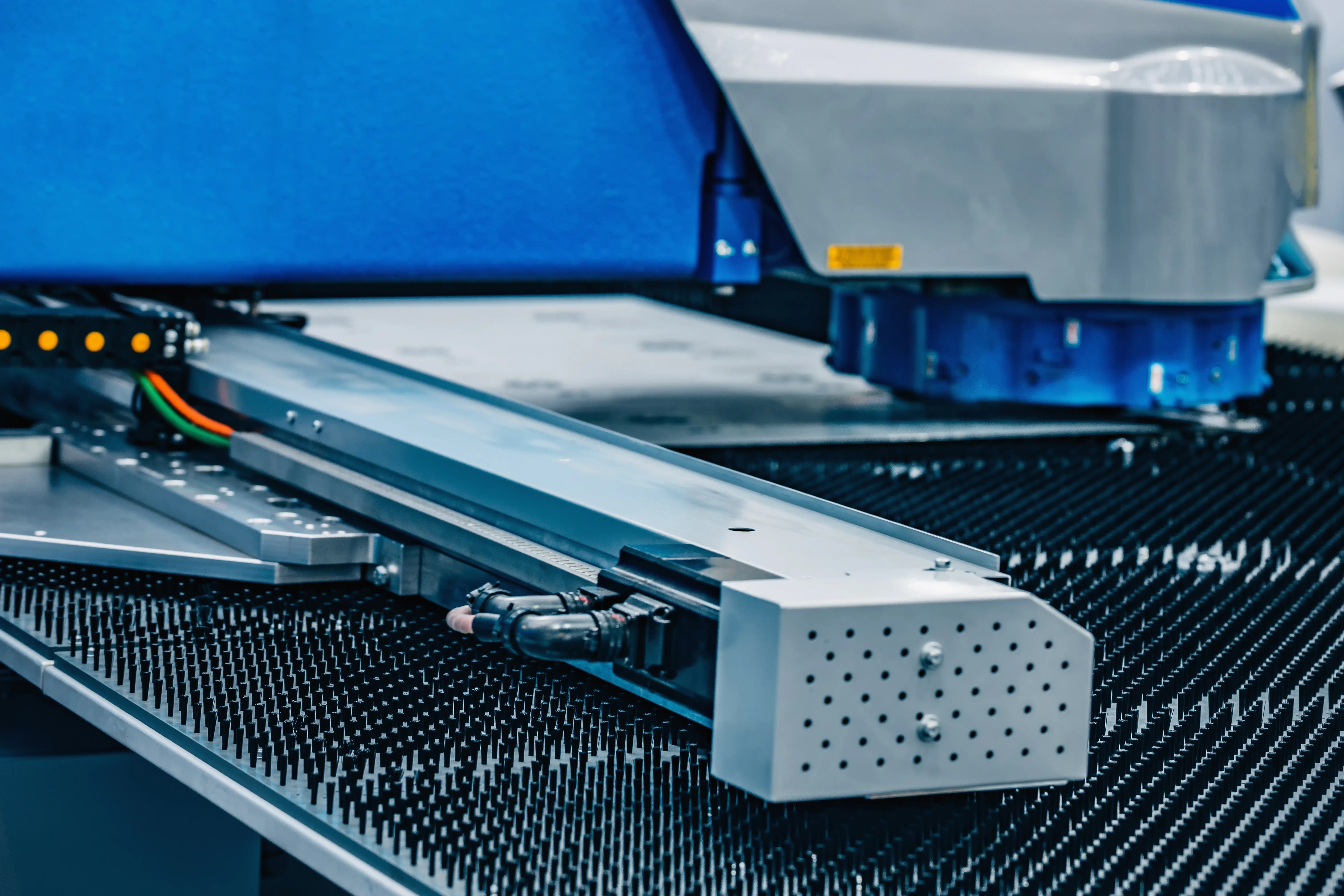

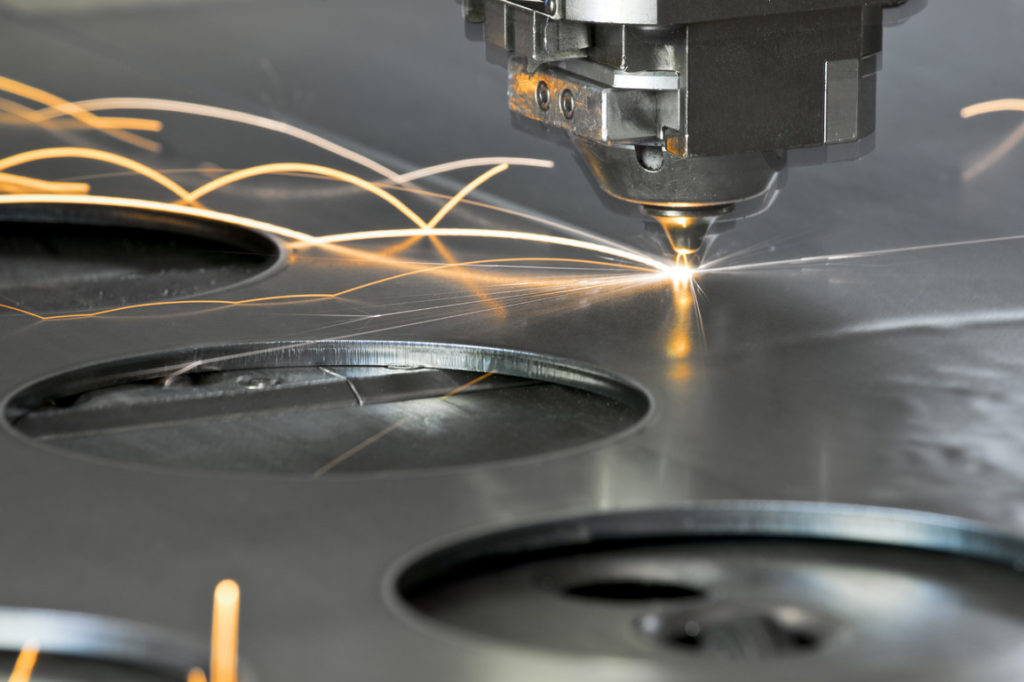

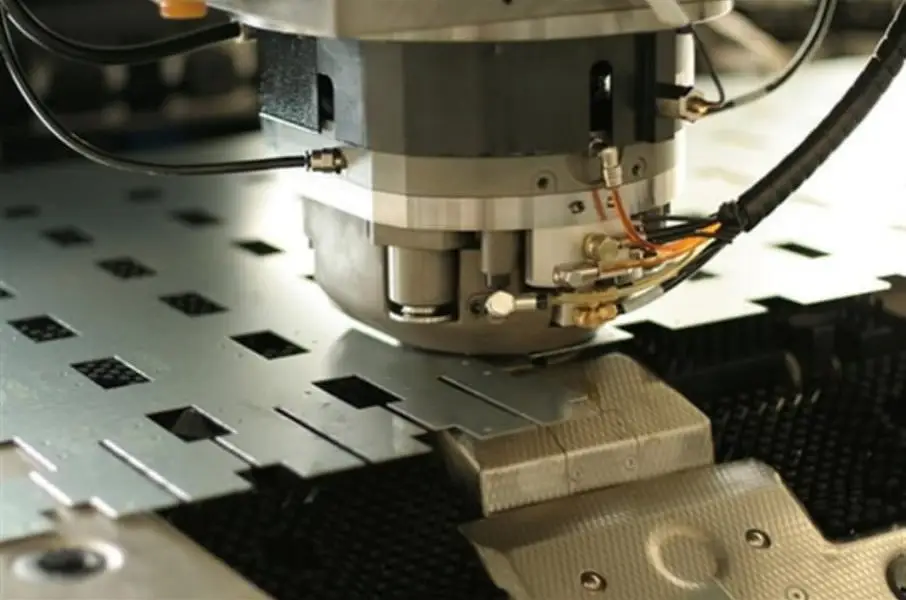

Advanced equipment: High-power fiber lasers (8–20 kW), automated panel benders, robotic MIG/TIG cells, and CNC press brakes with angle sensors.

-

Quality systems: Widespread adoption of ISO 9001, IATF 16949 for automotive, and AS9100 for aerospace, plus PPAP, APQP, and SPC practices.

-

Digital workflows: Online quoting portals, DFM feedback, and traceability via barcoding and MES integrations.

-

Integrated services: Tooling, powder coating, plating, screen printing, gasketing, and sub-assembly under one roof.

This brings shorter lead times, better repeatability, and a realistic path to scale from prototypes to tens of thousands of parts—all within city logistics.

A Practical Comparison Framework

Use this eight-pillar framework to benchmark fabricators apples-to-apples:

-

Capabilities & Equipment

-

Cutting: Fiber laser (bed size, kW rating, nitrogen/oxygen cutting), turret punch, waterjet, plasma.

-

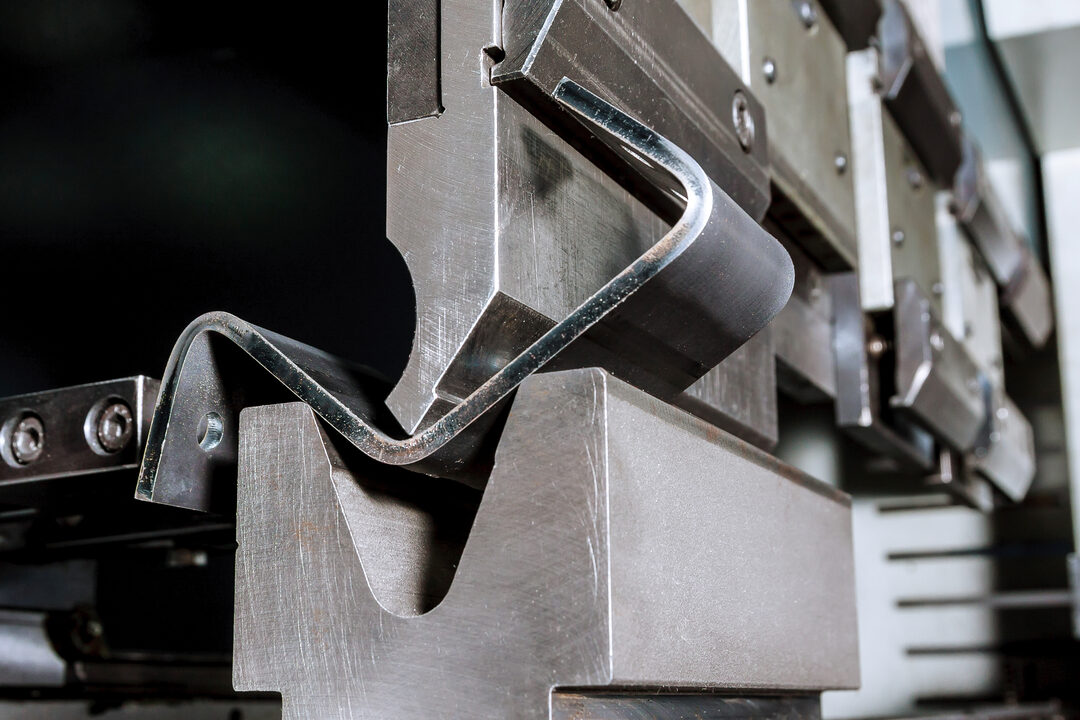

Forming: CNC press brake tonnage, panel benders, roll forming, hydroforming.

-

Welding: TIG/MIG, robotic cells, spot welding, brazing.

-

Finishing: Powder coating line specs (length, zones), anodizing/plating partners, brushing, bead blasting.

-

Materials: CRCA, HR, stainless (SS304/316/409), aluminum (5052/6061), GI/PPGI, copper/brass.

-

Thickness range: Typical sweet spot vs edges (e.g., 0.5–8 mm).

-

Tolerances: Flatness, bend angles, positional accuracy.

-

-

Quality & Certifications

-

ISO 9001 as baseline; add IATF 16949 for auto, AS9100 for aerospace.

-

In-process controls, FAI, PPAP, GR&R, MSA studies.

-

Inspection assets: CMM, height gauges, surface roughness testers, weld qualification (WPS/PQR).

-

-

Process Control & Traceability

-

ERP/MES usage, barcode tracking, batch-lot control.

-

Material certificates (mill test certs), heat number tracking.

-

-

DFM & Engineering Support

-

Early engagement on bend reliefs, K-factors, radii, and fastener selection.

-

Design change agility, value engineering, fixture/jig design.

-

-

Capacity & Lead Time

-

Machine uptime, shift patterns, WIP buffers, average queue time.

-

Prototype lead times (1–5 days) vs production (2–4 weeks), surge capacity.

-

-

Cost Structure & Transparency

-

Quoting logic (machine time, setup, material yield, finishing, QA).

-

Clear MOQs, price breaks, and tooling amortization.

-

-

Supply Chain & Finishing Partners

-

In-house vs vetted vendors for plating/anodizing/chemical processes.

-

Logistics capability—milk runs, kitting, packaging specs.

-

-

Culture, Communication & Reliability

-

Responsiveness, documentation hygiene, ECO handling, NCR closure time.

-

On-time delivery (OTD) and PPM trends.

-

Fabricator Archetypes You’ll Encounter (and When to Choose Them)

-

Prototype-First Job Shops

-

Best for: Early-stage design validation, one-offs, fast-turn samples.

-

Signals: Quick quoting, flexible setups, strong DFM, broad material stock.

-

Trade-offs: Higher unit cost, limited scale without planning.

-

-

High-Precision Specialists

-

Best for: Tight tolerances, complex assemblies, aerospace/medical devices.

-

Signals: AS9100/IATF, CMM rooms, weld and operator certifications, SPC culture.

-

Trade-offs: Longer NPI cycles, rigorous change control.

-

-

High-Volume Contract Manufacturers

-

Best for: Thousands to millions of parts, stable designs, recurring demand.

-

Signals: Lights-out automation, robotic welding, takt-driven lines, automated powder coating.

-

Trade-offs: MOQs, longer onboarding, engineering gates.

-

-

Niche Process Experts

-

Best for: Deep-drawn parts, enclosure aesthetics, heavy gauge structures, or unusual alloys.

-

Signals: Specialized tooling, references in your application, advanced fixture design.

-

Trade-offs: Narrow scope, scheduling constraints.

-

2025 Technology Trends Affecting Your Choice

-

High-Power Fiber Lasers: Faster cutting with cleaner edges in stainless and aluminum; reduces downstream deburring.

-

Automated Bending: Panel benders and angle-measuring press brakes increase repeatability on complex geometries.

-

Robotic Welding: Consistent beads, reduced distortion, improved throughput—especially for repeat assemblies.

-

Digital Quotations + DFM: Upload CAD, receive manufacturability flags (tight radii, punch-laser conflicts, grain direction issues) and price breaks instantly.

-

Green Finishing Lines: Energy-efficient ovens and low-VOC powders help sustainability and brand requirements.

-

Traceable Operations: Barcode-driven traveler cards and live dashboards for OTD/PPM make audits simpler.

Capability Checklist for Your RFQ

Before you issue RFQs to sheet metal fabricators in Bangalore, compile this dossier to improve quote accuracy and comparability:

-

Design Files: STEP/IGES, flat patterns (DXF/DWG), assembly PDFs with GD&T.

-

BOM & Materials: Alloy/grade, thickness, grain direction, material treatment specs.

-

Critical-to-Quality (CTQ) Features: Tolerances, cosmetic surfaces, weld aesthetics.

-

Finishing: Powder RAL codes, anodizing thickness, salt spray requirements, masking zones.

-

Hardware: PEM fasteners, studs, captive nuts—call out specs and installation direction.

-

Packaging: Individual wraps, corner guards, desiccants, EPE foam, palletization.

-

Testing: Fit checks, FAI, leak tests, load tests, surface roughness, adhesion.

-

Volumes & Cadence: Prototype qty, ramp plan, EAU, releases (monthly/quarterly).

-

Delivery Terms: Incoterms, delivery frequency, kanban expectations.

How to Compare Quotes (Beyond Price)

Price matters, but a low number can hide risk. Benchmark each vendor on:

-

Yield & Nesting Strategy: Ask how they minimize scrap on your sheet sizes.

-

Setup Reduction: Do they combine jobs or use common tooling to reduce changeover?

-

Bend Sequencing: Will your design require special fingers/dies or creative sequencing that adds time?

-

Fixture Philosophy: Robust, mistake-proof fixtures imply stable quality in scale.

-

Weld Heat Input Control: Especially for thin gauge stainless or aluminum, distortion control is a differentiator.

-

Coating Line Loading: Can they ensure uniform coverage and avoid Faraday cage effects?

-

Rework Handling: Clear MRB/NCR processes reduce surprises and delays.

Create a simple weighted scorecard (example weights shown):

| Criterion | Weight |

|---|---|

| Quality & Certifications | 20% |

| Capability Fit | 20% |

| Lead Time & Capacity | 15% |

| Cost Transparency | 15% |

| DFM & Engineering | 10% |

| Finishing & Supply Network | 10% |

| Communication & Culture | 10% |

Score each supplier 1–5 per row, multiply by weight, and sum for a final comparison. This makes justification to stakeholders straightforward.

Evaluating Quality Systems

Ask for and review:

-

Certificates & Scope: Verify current ISO/IATF/AS9100 certificates and exact scope (processes, locations).

-

Sample Control Plans: For production jobs, request a CP and PFMEA; check CTQs align with your drawing.

-

Inspection Records: See real examples—FAI reports, CMM data, weld PQR/WPS.

-

Gage Strategy: GR&R evidence for critical measurements.

-

Change Management: ECO/ECN logs, revision control discipline, and part marking practices.

Lead Times You Can Expect (Typical, Not Promises)

-

Prototypes: 3–7 working days if material is common and finishes are simple.

-

Small Batches (50–200 units): 1–3 weeks depending on coating/plating queues.

-

Production Runs (500+): 3–6 weeks; quicker with blanket orders and forecast schedules.

Lock these with the vendor in a Master Service Agreement along with OTD and PPM targets.

Logistics Advantage: Bangalore Layout

Choosing a fabricator near your plant or final customer reduces transit time and handling damage. Rough heuristics:

-

Peenya / Nelamangala: Dense cluster, rapid access to skilled labor and machine shops.

-

Bommasandra / Jigani: Strong for medium-heavy fabrication and integrated finishing.

-

Whitefield–Hoskote: Good for tech hardware, electronics enclosures, and export connectivity.

-

Hosur Road corridor: Many large campuses with automated lines and easy TN/KA cross-border routes.

Sustainability & Compliance in 2025

Brands increasingly ask for:

-

RoHS/REACH compliance for materials and coatings.

-

Powder Coating VOC management and energy-efficient ovens.

-

Wastewater treatment and sludge disposal documentation for finishing lines.

-

ESG reporting: Basic KPIs like energy per part and scrap rates.

If sustainability is a brand pillar, make it part of your scorecard.

Red Flags to Watch For

-

Quotes that omit finishing specs or assume “standard” without listing RAL/microns.

-

No mention of inspection beyond final visual checks.

-

Resistance to FAI or to sharing sample control plans.

-

Over-promising on lead time with no capacity explanation.

-

Poor documentation hygiene: mismatched revisions, missing drawing sign-offs.

Example: How a Shortlist Might Look (Illustrative)

Imagine you’re sourcing a powder-coated aluminum enclosure (5052-H32, 2.0 mm, PEM hardware, cosmetic faces, RAL 9005 matte). After an RFQ to six vendors, you narrow to three:

-

Vendor A — Prototype-to-Production

-

Strengths: Fast DFM feedback, tight bend control on 2.0 mm aluminum, in-house PEM insertion, quick powder line changeovers.

-

Considerations: Limited anodizing; partners for plating add a week if needed.

-

Best for: Rapid prototypes and first three batches with frequent engineering changes.

-

-

Vendor B — High-Precision Specialist

-

Strengths: AS9100, CMM-heavy inspection, strong weld distortion control, flawless cosmetic finishing.

-

Considerations: Higher piece price; prefers stable drawings.

-

Best for: Premium enclosures where cosmetics and tight GD&T dominate.

-

-

Vendor C — Volume Contract Manufacturer

-

Strengths: Robotic welding, automated panel bender, takt planning, stable OTD in thousands/month.

-

Considerations: Minimum order quantities, longer NPI; requires PPAP.

-

Best for: Mature designs with predictable, recurring demand.

-

By mapping your forecast (e.g., 50 prototypes → 300 pilot → 2,000/quarter steady state), you might start with Vendor A, qualify Vendor B for a premium variant, and nominate Vendor C for scale once ECOs stabilize.

Negotiation & Partnership Tips

-

Bundle SKUs with common material and finish to unlock price breaks and shared setups.

-

Supply Material or Allow Substitution where acceptable (e.g., 5052 ↔ 5005 for coating uniformity) to improve availability.

-

Design for Coating: Add drain/vent holes and masking notes to cut rework.

-

Tooling Investment: Simple brake tooling or fixtures pay back quickly through reduced cycle time/variation.

-

Vendor Managed Inventory (VMI): For repeat parts, VMI or kanban bins cut your lead time and safety stock.

FAQ: Sheet Metal Fabrication in Bangalore (2025)

Q1: Are online instant quotes reliable?

They’re great for ballparking and for simple parts. For assemblies, cosmetic faces, or tight GD&T, insist on engineer review and a formal quote.

Q2: How do I protect cosmetic surfaces?

Call out grain direction, protective film, and packaging. Specify no-touch zones and masking for coating.

Q3: How early should a fabricator join design?

As early as bend radii and fastener strategy are decided. Early DFM avoids downstream rework and surprise costs.

Q4: What’s the most common cause of delays?

Ambiguous drawings/finishing specs and late hardware/material availability. Clear RFQs and flexible alternates reduce risk.

Q5: Is dual-sourcing worth it?

Yes—qualify a secondary vendor for continuity. Share the same FAI pack to keep parts interchangeable.

Final Takeaway

Bangalore offers one of India’s most capable, cost-effective ecosystems for sheet metal fabrication in 2025. Instead of chasing the lowest unit price, build a structured comparison around capabilities, quality systems, DFM depth, and capacity fit for your demand curve. Start with fast, DFM-savvy shops for prototypes, qualify a precision specialist when tolerances or cosmetics tighten, and transition to a volume player once the design stabilizes. This staged approach de-risks your launch, keeps lead times tight, and protects quality—while still delivering total landed cost advantages.

If you’d like, share your part drawings, materials, finishes, and expected volumes—I can generate a tailored RFQ checklist and a weighted scorecard you can use to evaluate your shortlist of sheet metal fabricators in Bangalore.